Just like you delay your investment decisions in your financial planning, do you also delay investing your salary each month in the right investment avenues ? If yes, you are not alone. A whole lot of investors are used to accumulating their salaries each month in their bank accounts as they do not know what to do with it. Using Auto Sweep Facility for your savings account is always a wise thing to do.

There are other investors who do not want to commit to long term investing – for them, an Auto Sweep account can be used to get the best out of banking services.

What is an Auto Sweep Facility ?

Auto sweep in facility has many different names to it – so part from auto sweep in, it is also called as flexi fixed deposit or a two-in-one account.

This is a facility that links your savings account to a fixed deposit (FD) and transfers any money lying in that account above a defined threshold to the FD. The obvious advantage is that you earn more interest on the money that is in your FD while you continue to enjoy the lower rate of interest on the money in the savings account. Note that this FD is always linked to the relevant savings account.

Further, when an amount of money is transferred from your savings account to the FD, it is called a sweep out and when the money is transferred from the FD to the savings account, it is called sweep in or the reverse sweep facility.

How does Auto Sweep Account work ?

The customer or the bank decide on a threshold limit of money that has to be parked in the savings account. Suppose that is Rs 10,000/-.

Anything above this money will be auto swept into a FD and you will continue to earn a FD interest on it. So , if you have parked Rs 17,000/- in your account, Rs 7000/- will be swept out into a FD while Rs 10,000/- will be in your savings account.

Whenever you need more than Rs 10,000/- you can withdraw that money and it will be debited from the FD of Rs 7,000/- and will be swept in to your savings account.

How much more can you earn ?

Let us consider a case where in you have parked Rs 25,000 in a normal savings account with 4% interest. The following depicts how much interest you will earn after a year.

| Normal Savings Account | |||

| Amount | Rate Of Interest | Maturity Amount | Interest Earned |

| 25,000 | 4.00% | 26,010 | 1,010 |

But suppose instead of doing this, you were to break this Rs 25,000 into 5 sweep ins each of Rs 5,000/- which earn different rates of interest for a year. The following shows the returns in this case.

| Auto Sweep Accounts | |||

| Amount | Rate of Interest | Maturity Amount | Interest Earned |

| 5,000 | 6.00% | 5,305 | 305 |

| 5,000 | 5.50% | 5,279 | 279 |

| 5,000 | 6.50% | 5,330 | 330 |

| 5,000 | 7.00% | 5,356 | 356 |

| 5,000 | 7.50% | 5,382 | 382 |

| 1,652 | |||

As you can see, you are earning more. If the amount that you park in your sweep account is huge, the difference in interest earned can be significant.

The parameters that drive this difference is the rate of interest and for how long you have used this facility.

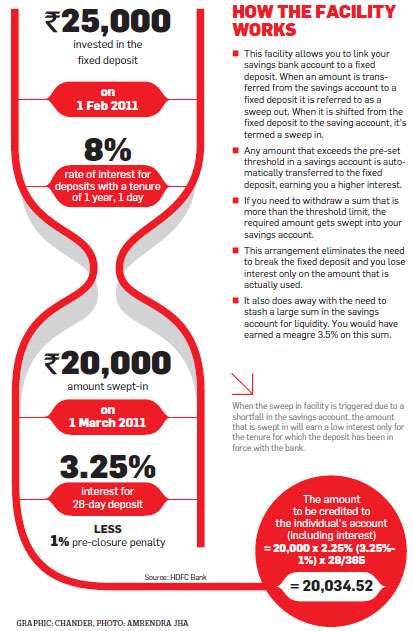

Here is a very nice pictorial example I got from Economic Times.

Other points to take note of

You must note the below points when you use auto sweep facility for your money.

1. Some banks will levy penalty on premature withdrawal, that is on sweep ins. So if they expect to park your money into sweep in accounts for a specified period, then to make best returns possible, it is wise to stick to that period.

2. Some banks offer simple interest on the sweep in accounts as against cumulative that is available on fixed deposits.

3. The FDs can be broken on First In First Out (FIFO) basis.

4. The FDs is broken to the nearest rupee.

5. Almost all banks offer this facility however name it differently. The banks have their own threshold limits and rules.

Auto Sweep facility combines the liquidity of a regular savings bank account with the high yield of a fixed deposit, so why miss it when you can get your money to work for you ? !

Good comparison & calculative findings.But the interest income from sweep in accounts also are taxable as per income tax slabs.Right?I dont think it wud be any value for those in 30% slab like me..I wud like to invest that amount in some debt liqid or bond fund, but yes, i cant expect liqidity like in here.What say?

@Muthu, Yes it is taxable.

You need to park your emergency corpus here. SO more than use, it is an avenue that you need for a purpose. You might have to compromise on the overall returns but still go for it as it is mandatory to have.

Hi Radhey, You have provided good information on features of sweep-in facility for savings account. However, I don’t like to use this facility due to following reasons: –

1) Suppose someone is trying to save some money to be used in next 3-4 months, the money will be pulled into FD and unnecessary penalty have to be paid by the customer.

2) In my opinion this facility is giving more benefit to the bank rather than the customer. Banks pulls-in more money to invest and earn by charging penalties. It’s a win-win situation for banks.

3) We all know that investment in FDs should be the last option in the list due to low returns post-tax. Even if I were lazy, I’d prefer to give standing instructions to be invested in SIPs and other investments.

4) These days almost all the banks are giving option to book FDs via Internet Banking in just 2 steps. I’d prefer to use that whenever I feel I have excess money sitting in my savings account.

5) Also, I heard that interest on savings account has been increased to 6% now. This makes the sweep-in facility even less lucrative for short term.

This feature can be used by people who have done zero financial planning and all their money simply sits in the savings account OR who want to invest only in FDs. But what are such numbers?

@Vivek K, That is not correct Vivek.

The decision to go with a SIP or a sweep in account is not based on which returns more, it is more importantly based on what are you putting the money aside for.

Sweep in accounts should not be used for long term goals.

You can however keep money for emergency here. And not all of it. Only part of it – the rest should be in FDs.

@Radhey Sharma, The sweep-in option might be useful for emergency funds account.

I agree that decision to go with SIP or sweep-in account should not be purely on returns. I mentioned about SIPs because the article started with “A whole lot of investors are used to accumulating their salaries each month in their bank accounts as they do not know what to do with it.” If people do not know what to do with their salaries so chances are they are not going to use the funds in near future. Hence my thought is to utilise it in a better option of making SIPs.

Also, can you please confirm the interest rate on savings account? If it is 6% then it will make the comparison more interesting 🙂

I remember seeing the famous “Subu” advertisement of Kotak Mahindra bank promoting 6% interest on their savings account: “Don’t think it as 2% extra, think it is 50% increase.” What an innovative marketing gimmick! 🙂

@Vivek K, Yes in a way you are right. For people who do not know what to do with their money, its better to park in FDs than in sweep in accounts.

The rates are more than 4%. See

https://www.thewealthwisher.com/2011/11/01/deregulation-of-interest-rates-on-deposits-starts-interest-rates-war/

I am not sure what the sweep in interest rates are, probably I could get the specifics and do a quantitative analysis.

But the point really is that even if the difference is say 1%, why not go for it !

Thanks Radhey..

Glad to see that u sincerely consider the request of readers.

This has encouraged me to keep on querying……….. 🙂

@Aparna,

Yes I agree, Radhey takes good care of his readers. You will see a new post every other day and he will always reply to your comments.

Rakesh

I am not able to understand how to transfer money from SBI salary account to SBI sweep in account. Can you guide me whats the way doing it in Online SBI.

@Aparna Nema, Glad you liked it.

@Radhey,

Very well explained, like the use of chart. I have enough funds lying in savings @ 4% p.a. But unfortunately ICICI does not have this facility anymore and HDFC insists to open a new account to avail this facility. Already have over 6 accounts and managing them is difficult.

Rakesh

@Rakesh, Yeah, ICICI closed it down. Managing more accounts is very difficult and cumbersome.

Perfect solution for saving for emergency fund.

Plan for it as per your requirement, readily accessible yet protects from the petty/non-emergency expenses.

Thanks for giving this information Radhey :). Since long time thinking about this, going to add one more point in my action list.

@ Radhey,

Probably for some banks accounts this may now become irrelevant. Consider for example high interest rates being provided by banks such as Kotak & Yes bank.

I think a hand-in-hand topic is investing into Liquid funds which would provide the funds into the bank account in 1-2 working day notice. The returns should be much better than a Auto Sweep facility.

Check out http://insight.banyanfa.com/?p=62. Considering your article is very relevant to manage idle funds, would you allow me to mention the link of your this page on my blogsite ?

Regards

BFA

@Banyan Financial Advisors, You don’t have to ask to link to any of my pages, you can do it freely.

Hi Radhey Sharma,My monthly Salary is Rs13840/-. I read this article . I am also interested to open an a/c .Please tell me in which bank i have to open. I am staying in a rural area only SBI, SBH available.Like me low single income people can do this advantage. please provide ur suggestions.

I am waiting for ur reply.

Regards,

Praveen

You can open in SBI as they have the option of auto sweep accounts. Let me know if you having any difficulty.

hi..

Is it possible to make my sbi A/C into sweep account through online

Regards

chandan

@Chandan,

You will have to visit the bank in person.

@Praveen,

You can contact SBI bank and inquire about the auto-sweep facility. Try to do it online so that you can easily mange it.

Thank You Rakesh & Wealth Wisher for following ,

i talked in my home regarding this facility. My parents and brother told ” if u having more money after ur compulsory expenditures completion, then u invest. Because we r middle class family, daily we need more money. Our’s remaining amount at the month end will very less”.

I am in confusion when , how to open this account in a year . I searched in http://www.sbi.co.in website for online Auto sweep facility. But i did not found.

I am waiting for ur reply.

Regards,

Praveen

I do not quite agree with the “invest after you spend” approach. It’s going to kill you. You must ensure that you invest at least 20% – 25% of your take home otherwise you are in trouble. It is wrong to think that middle class people cannot invest. For everyone, the principle of investing at least 20% of net take home holds true.

@Praveen,

Your welcome. I think it would be better to visit your nearest SBI branch in person and speak to the officer, they will be in a better position to assist you.

On the website you can go to Personal Banking – Deposit Scheme – Savings account and look for more information.

Thank u for Wealth Wisher and Rakesh,

Once again thanks to Wealth Wisher,by giving an idea that how much should i invest from my take home salary. Once again i am asking you because i am in confusion where, how to invest from my Net income salary Rs13840/-. I am from ordinary middle class family. I am interested to improve my financial structure. how can i do it? My upcoming expenditures are Old house reconstruction, My parents medical bills , Doctor fee,my marriage, brother marriage, to survive every day expenditures like Groceries, Vegetable, small functions, Govt bills, mobile recharges…etc. please provide ur suggestion that how can i improve my financial structure.

I am waiting for ur reply.

To Rakesh: I will go to bank and discuss with the officer. How much penalty should i pay if o with draw the Rs 10k below. I seen the website”Savings Bank account permitting to withdraw funds from Term Deposits in units of Rs.1000/- by issuing a cheque on Savings Bank Account” means???

I am waiting for ur reply.

Regards,

Praveen

Praveen, you will need financial planning to answer the question on where to invest for these short term and medium term and long term goals. Pick 2 equity diversified MFs and begin parking your money into them. Select 1 debt fund to start with and put away money systemaatically into it.

@Praveen,

With SBI the minimum bank balance is Rs 1k and not Rs. 10K which is with other private banks namely HDFC, ICICI. As for the second statement it means you can withdraw Rs. 1k, 2k, 3k and so on, that is in multiples of Rs. 1000.

CAN ANY ONE PROVIDE AN EXAMPLE OF ONE LAC ACCORDING THIS FACILITY

HOW THE INTEREST WIL CALCULATE.

THANKS

@Rakesh,

Thank u for providing to give clarity , but i reached up to bushes of the tree,”with draw Rs 1k, 2k,3k …etc in multiplesof Rs 1000/-. Can we cannnot with draw with our debit ATM cards as per requirement.Currently i am having one sbi a/c. for this auto sweep facility, is bank will provide new a/c number with cheque book without atm card.

I am waiting for ur reply.

Regards,

Praveen

You can withdraw money using the ATM card, not sure whether I understood your question though.

what is the rule of maturity amount of sweep account.

hi mr. radhey sharma, i am a doctor student earning 40000 monthly. i wanted to borrow 100000 rs from a friend of mine who maintains sweep in account. i told i would pay him 9% interest that is more than wat he is getting in sbi ,until i return him his money. but he argues that if he withdraws that money he would lose whatever interest that has been earnt till now(may be 9-10 months,because he started it on 2012 oct). i am confused or i dont completely understand wat this really mean. please help me to understand. waiting for ur response humbly.

Can i transfer sweep amount through online if i need?

Hi Radhey

What is amount of TDS deducted for the interest earned?

Thanks

Ritz

can i get separate passbook for the sweep a/c ?

Hello sir I just want to know how penality on auto sweep will be calculated my balance in FD is 370000 and maturity period is just end up on 7august 2016

Penality rate of SBI is .75℅

Hello Sir,

I have a savings a/c with SBI and I have already applied for enable auto sweep facility in my a/c 10 days ago. Now my problem is I can not understand that whether the auto sweep facility is enabled or not. Can any one tell me that what is the procedure to identify whether my account is auto sweep enabled or not?

The best way would be to call the call center and ask for confirmation. Normally it takes 1-2 days to activate this facility.