TATA AIA Life Insurance company has launched it’s online term insurance plan called TATA AIA Life iRaksha Supreme. For those who are new to the concept of term insurance being sold online, please be aware that there are other insurance companies life ICICI Prudential, HDFC Life Insurance, Aegon Reliagre among many others who have already launched their online term plans.

The latest to join the band wagon is TATA AIA life insurance company. Tata AIA Life had in the middle of 2012 launched a new term insurance plan by the name of Maha RakshaSupreme – this was an offline term plan – what you have now is the online version. Let us look at some salient features of TATA AIA Life iRaksha Supreme.

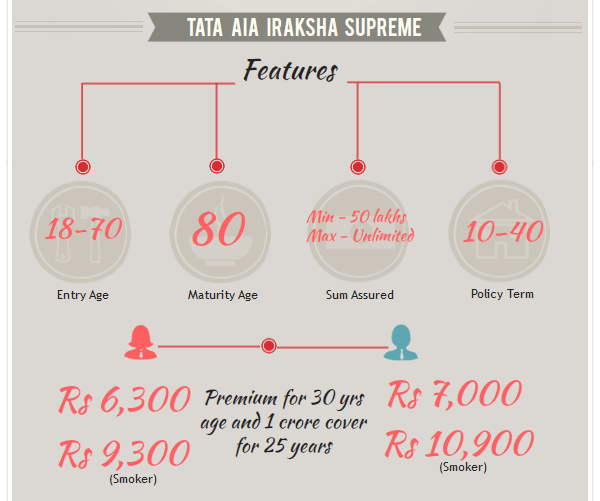

Features of TATA AIA Life iRaksha Supreme

Tata AIA Life is using the tag line – “You click, we cover” to sell this product online. Starting from a minimum age of 18 to maximum 80, TATA AIA Life iRaksha Supreme offers a minimum live cover/sum assured of Rs 50 lakhs with no maximum limit. You must first read this article and understand how to calculate your life insurance needs. There is a plethora of premium payment options that are made available to the investor. You can either pay each year till the end of the policy term or you can choose to pay a single premium. There is a middle choice as well – pay for some years (5 or 10) and get life cover for your chosen tenure.

Discounted rates are offered for high sum assured policies. So if you were to take a policy with sum assured of Rs 75,00,000 to 99,99,999, the discount per 1000 sum assured will be 0.1. This goes up as the sum assured increases and if you take a policy with sum assured of 5,00,00,000 and above, then the discount is 0.25 per 1000 sum assured.

TATA AIA Life iRaksha Supreme has a free look up period of 30 days as per regulations that insurance policies need to fall in line with – what this means is that if you do not like the policy you need to return it to the insurer within 30 days of receipt and your premium will be refunded to you.

Since this is a pure vanilla term plan, there is no maturity benefit – what that means is that if you survive the policy term, you get nothing. But if you die during the term of the policy, your family members get the sum assured – this is exactly what a term plan is meant to do and so this is a product which investors should look at if they want to cover themselves in the right manner.

Needless to say, you cannot take a loan on this policy. Also, the premiums that you pay under TATA AIA Life iRaksha Supreme are eligible for tax benefits under Section 80C of the Income Tax Act, 1961.

Should you buy TATA AIA Life iRaksha Supreme ?

With so many online term plans out there – should you buy TATA AIA Life iRaksha Supreme ?

I believe that as long as you fill in the insurance form yourself and fill it in the right details and do not hide anything, there is nothing to fear. You do have fan followings of ICICI Prudential iCare, Aegon Religare iTerm, HDFC Click 2 Protect and other online term plans as well. You must have read about the fact that one should go with insurance companies which have a good claim settlement ratio – I don’t quite believe in that as each and every insurance company will pay as long as you provide the right set of information. Do read whether your life insurance company will pay the claim on your death ?

You need to know that TATA AIA was formerly TATA AIG and so it might make sense to do some homework on this joint venture and convince yourself that you are making an association with the right insurance company.

Also, be aware that you will be subjected to tough underwriting norms and getting the cover might not be a walk in the park. As you can see, a minimum sum assured of Rs 50 lakhs means that this is meant for those individuals who are earning well and need a high end term insurance plan to cover themselves.

Would you buy TATA AIA Life iRaksha Supreme – if not, why ?

Thanks for the article !

I am trying to check out a few term plans now – though I’m in no hurry to take one now. I’ve just calculated the premium and here are some figures that might help others (From the Tata AIA calculator):

For a Non-Smoking Male of 27 years of age for a regular payment option (not a one-time or limited term option):

1. Sum Assured: 50 L

Policy Term: 35 yrs

Premium: Rs.4719/- annually or Rs. 2407/- semi-annually

2. Sum Assured: 75 L

Policy Term: 35 yrs

Premium: Rs.6236/- annually or Rs. 3181/- semi-annually

3. Sum Assured: 75 L

Policy Term: 30 yrs

Premium: Rs.6067/- annually or Rs. 3094/- semi-annually

I thought this was a decent figure and somehow have this notion of a better claim settlement rate owing to the brand Tata.

What did you opt for Rohit ?

I am planning to take one after this financial year Radhey. Single now, so no worries 🙂

Hi sir, Im Life planer from TATA AIA as ur looking for buying term plan. (Comment edited)

Hi Rinkesh… thanx for your comment but do not market products here as we feel products comes after the financial planning. So keeping visiting us to know more about Financial Planning and other concepts.

One comparison –

For 35 years male for a term plan of 35 years without any riders i.e. pure protection of 1 crore, these are premiums from

TATA AIA Life iRaksha Supreme – 16900

AEGON Religare iTerm Insurance – 9800

Rs. 7100 – now that’s a significant difference !! Because you have mentioned that you don’t believe in claim settlement ratio, is there any other pitfall in Aegon ? I don’t see any other reason otherwise to go for Aegon.

I don’t think so – surprised to see the difference in premium – where did you get this from ?

I entered same details on both web-sites to calculate premium and these are the results. You can also give a try.

Hi

I think the only and best feature of TATA AIA i Raksha Supreme is the option for limited premium payment. For instance an individual buys this policy at age of 30 and opts for 10 years premium payment he will need to pay around Rs 20000 / year for 10 years means Rs 2,00,000 for a cover of 1 Crore for a term of 40 years. And we all know that after 40 or rather 50 years of age we do not have a good source of income and if we fail to pay in that age entire cover is lost. And that is one way how any term insurance company makes money.

I think 10 years and 5 years premium payment period is the best part of this policy.

@duffer….as per your requirements, the quote is Rs. 8,652/year meaning 346,080Rs. in the span of 40 years. Right that in 10 years time, you pay less apparently but considering inflation, Rs. 8652 after 40 years (8% yearly)shall be equal to 1,87,560 Rs. which means for a value of 187,000 Rs. you shall pay Rs. 8652 then. On the other hand, 20,000 that are payable 10 years from now shall be equal to a little more than 2,00,000 in a period of next 30 years. If you consider the time valve of money, it is wise to spread the payments over a period of time. 8652 shall be a meager amount then (after 40 years) to pay for your insurance.

DEATH BENEFIT

1)SA

2)10 TIMES OF ANNUAL PREMIUM

3)105% OF REGULAR PREMIUM

WHAT DOES 2 AND 3 MEAN ON WHICH CRITERIA?

Hi my name is harsh , age 30 yrs. I recently applied for a 1 Cr, 35 yrs term plan with 9103 annual premium till term end and same is in verification process as I write it. a Freelance fin. adviser has recently advised me against TATA AIA in terms of long term credibility , and customer service ref. TATA AIG model exp. in india and advising to take Fully Indian bank co.’s like ICICI and HDFC and NO. indian and Foreign JV’s as Foreign Co. may get separated in future and other Indian partner may introduce new T&D/additional charges etc etc( esp. gave me a exp. of a reliance insurance win which cust. were harassed and other unethical changes brought)

I still have scope of backing out and take a better plan. Pl suggest. I had opted it for 2 reasons:

“Least annual premium among many options checked covering a 35 yr period” and TATA group’s brand trust.!!

Pl guide and suggest w.r.t. your knowledge,opinion and other best options available.!!!

request quick support on this.!!

Dear Harsh,

I hope that you have done the basic diligence that the insurance is congruent to your long term goals and product suits your planning. I commend that you are buying term insurance and not mixing it as an investment product. If you are satisfied on that part the other things you need to see is Claim-Settlement Ratio and company background. As you said TATA is a trusted brand and all insurance companies are regulated by IRDA so i don’t see problem there. For Claim Settlement Ratio (although Indian companies fare better than global peers as Majority are above 80%) you may check this:

https://www.irda.gov.in/ADMINCMS/cms/frmGeneral_NoYearList.aspx?DF=AR&mid=11.1

For TATA AIA refer to Annual Report 2013-14 released 08 Jan 2015 Page 114.

In my opinion if you are satisfied on above points… you are good to go. Just a word of caution… fill the form correctly and provide all information asked- in good faith. In case this is online policy (may be this is the reason your adviser is discouraging as he will not get anything) you may contact company representative to assist you and solve any doubts related to form filling. Take Care..

Please let me know a detail information whether nominee will get the death benefit within the policy term in case insured will die in foreign countries (outside India)? I go through the brochures in details but I do not find any information regarding it? Kindly give me if there are any exceptions.

Please let me know a detail information whether nominee will get the death benefit within the policy term in case insured will die in foreign countries (outside India)? I go through the brochures in details but I do not find any information regarding it? Kindly give me if there are any exceptions. – See more at: https://www.thewealthwisher.com/2013/01/31/tata-aia-life-iraksha-supreme-term-plan-review/#sthash.qSo4COEG.dpuf

I Raksha supreme

Age 32

Risk cover 5000000

Policy term 40 years

For me 38 years

Premium

One time – 114786/-

5 year(per year) 24560/-

10year(per year) 13511/-

In this premium

All types of death covered ?

Sir myself sriniwas rao s age 51 wanted to take online term plan for 15 lac max.term i.e 70 to 80 years i m non smoker male

Yes diabetic person within limit

Which company is better i choose pnb metlifes mera term plan which is good

I need ur advice as well as ur guidance

Thanks sir

rao.ssngp@gmail.com

Mr. Sriniwas,

Yes PNB Metlife policy is good with less premium compared to others. My only suggestion is to try and get more cover. Although requirement depends on liabilities and current income, but 15 lakh is a small amount. Normally we ask, will family survive or all your responsibilities will be fulfilled with Rs 15 lakh in the unfortunate case that you expire? Just think on those lines, match requirement with what premium you can pay and then take the policy.

Keep sharing your views.