It is the time of the year when tax saving investments rule the roost. Milking the opportunity high and dry are insurance companies who come out with a slew of investment products that help in tax saving purposes.

The biggest insurance company in India has come out with it’s LIC New Jeevan Nidhi insurance policy. Needless to say, it is going to make a killing in the market for the simple reason that the LIC brand is too big a player to not find sellers and there are anyway too many buyers who do not know what they are buying.

But does it make sense to buy LIC New Jeevan Nidhi insurance policy?

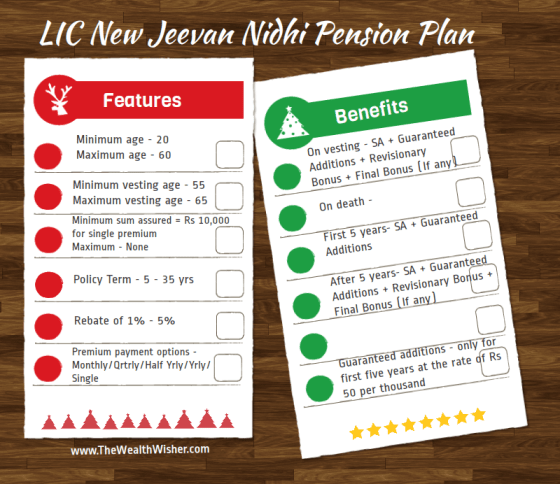

Features and Benefits of LIC New Jeevan Nidhi

LIC New Jeevan Nidhi is a pension plan from LIC – it is a bonus deferred annuity plan. The idea is to start saving for your retirement now and at retirement, you withdraw 1/3rd of the corpus and get pension with the remaining 2/3rd of the money. Of course, nothing stops the person from taking pension on the full corpus.

Let us talk a bit about the benefits which is what many readers might be interested in.

There are guaranteed additions in this policy for the first 5 years – to the tune of Rs 5 per 1000 sum assured for each completed year. From the 6th year, the policy shall participate in profits that LIC earns but this is not guaranteed. In case you do not know, this comes via the form of Simple Revisionary bonuses from the insurance company. There could be final additions of bonus as well but that again is not guaranteed.

In case of death, the sum assured with guaranteed additions or/and bonuses received will be paid out.

Once the policy matures, you will need to buy an annuity product from LIC itself. This is in line with the new regulations from the insurance regulator which says that the policyholder will need to necessarily buy annuity from the same insurance company.

Here is a snapshot of the features and benefits of LIC New Jeevan Nidhi pension plan.

Should you buy LIC New Jeevan Nidhi ?

LIC has given an illustration at it’s website about New Jeevan Nidhi. To elaborate, if a male of 35 years of age buys this plan with sum assured of Rs 1 lakh then his premium will be Rs 4121/- p.a. If the person keeps paying premium till 60 years of age, the product will give Rs 1,25,000/- (@4% p.a ) or Rs 2,33,500/- (@ 8% p.a).

But how much does LIC New Jeevan Nidhi actually return ?

The honours on this have been done by all my peer personal finance experts. Jitendra takes the policy to the dressing table here to say it will only return 1.38% and 5.76% at 4% and 8% investment rates of return.

Another piece which writes on the product from its return perspective is Mani’s take here. And Manshu’s review goes here.

Now that all of them have given their feedback, I am not sure whether it makes any sense to waste any more time writing about it myself. The consensus is common for all – LIC New Jeevan Nidhi is a policy that is best avoided.

It is of utmost important to understand that you cannot lock yourself in these products if you are planning to save money for your hey days. If you have already put in your money, check out how you can surrender after 3 years of completion of the policy. Or you can make it paid up. Read more on surrender value and paid-up value of a life insurance policy to understand more.

Note that this is a pension plan which means that it is meant for a goal that is too far away in the future. Readers here know that for long term investing, equity is the best way to go. Endowment plans like these will come a cropper and leave you with a meager 7% or so. The question is – do you want to put in money over so many years just because you wanted to save tax ?

how much guaranteed is the return from equity? completely 0%. what ever we assume is from past experience. but in this plan there is something is guaranteed, for first 5 years 5% and then the sum assured part at least. actually in long run, nothing can assure more return than any endowment insurance plan like this plan.friends, always return is not the matter of consideration. for long term investment without any tension and stress, an endowment insurance plan is best, as one know how much he needs to pay through out the plan.in other tools, it may vary time to time. which lacks regularity. of course some amount of surplus income may be invested in equity market for higher return, but one should not take the risk of investing his whole future in risky equity market.

I agreed. This policy should be look at retirement only.

Dear Shivajit,

I think you missed the line… the policy is to be avoided completely. There are host of better products to start retirement planning. Life insurance should not be used to plan for retirement.

Thanks for sharing your feedback. Keep visiting.