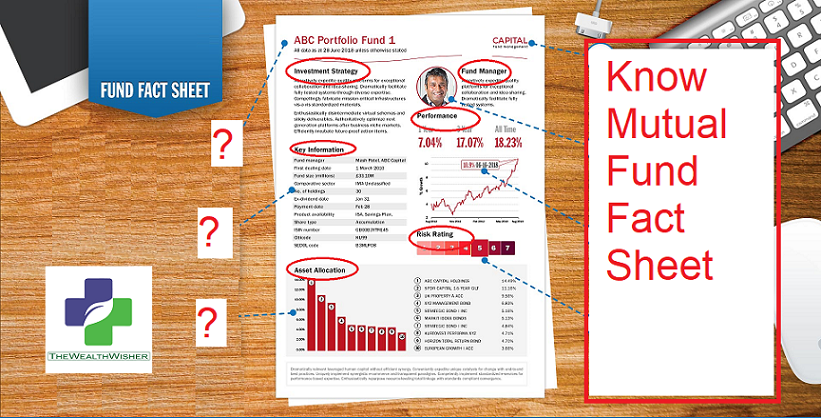

When you want to invest in Mutual Fund Schemes with any fund house, it’s important to know as much as possible about the fund house, about the schemes, about the fund manager who will be investing your money, etc. Factsheet entails these and many such details desired by the investor or advisor. One should know how to read mutual fund fact sheets & understand mutual fact sheet.

Hence, factsheet information is very important. Understanding the mutual fund fact sheet is not only important before making an investment, but existing investors should also read to get updated information on their investments. Here is the collection of 25 top terms mentioned in MF fact sheets.

How to Read Mutual Fund Fact Sheet?

AMFI or the Association of Mutual funds in India, has urged the fund houses to bring uniformity in the factsheet. Hence effective from October 2015, mutual fund factsheets will have the following 25 terms & information mentioned and explained below.

Fund Manager

An employee of the asset management company such as a mutual fund or life insurer, who manages investments of the scheme. He is usually part of a larger team of fund managers and research analysts.

Application Amount for Fresh Subscription

This is the minimum investment amount for a new investor in a mutual fund scheme.

Minimum Additional Amount

This is the minimum investment amount for an existing investor in a mutual fund scheme.

How to Read Mutual Fund Fact Sheet for SIP

SIP or systematic investment plan works on the principle of making periodic investments of a fixed sum. It works similar to a recurring bank deposit. For instance, an investor may opt for a SIP that invests Rs. 500 on every 15th of a month in an equity fund for a period of three years.

NAV

The NAV or the net asset value is the total asset value per unit of the mutual fund after deducting all related and permissible expenses. The NAV is calculated at the end of every business day. It is the value at which an investor enters or exits the mutual fund.

The NAV or the net asset value is the total asset value per unit of the mutual fund after deducting all related and permissible expenses. The NAV is calculated at the end of every business day. It is the value at which an investor enters or exits the mutual fund.

Benchmark

A group of securities, usually a market index, whose performance is used as a standard or benchmark to measure investment performance of mutual funds.

Some typical benchmarks include the NIFTY, Sensex, BSE200, NSE500, Crisil Liquid Fund Index and 10-Year Gsec.

Entry Load

A mutual fund may have a sales charge or load at the time of entry and/or exit to compensate the distributor/agent. Entry load is charged when an investor purchases the units of a mutual fund. The entry load is added to the prevailing NAV at the time of investment. For instance, if the NAV is Rs. 100 and the entry load is 1%, the investor will enter the fund at Rs. 101.

(Note: SEBI, vide circular dated June 30, 2009, has abolished entry load and mandated that the upfront commission to distributors will be paid by the investor directly to the distributor, based on his assessment of various factors including the service rendered by the distributor).

Exit Load

Exit load is charged when an investor redeems the units of a mutual fund. The exit load is reduced from the prevailing NAV at the time of redemption. The investor will receive redemption proceeds at net value of NAV less Exit Load. For instance, if the NAV is Rs. 100 and the exit load is 1%, the investor will receive Rs. 99.

Yield to Maturity (YTM)

The Yield to Maturity or the YTM is the rate of return when a bond is held until maturity. YTM is expressed as an annual rate. The YTM factors in the bond’s current market price, par value, coupon interest rate and time to maturity.

Modified Duration

Modified duration is the price sensitivity and the percentage change in price for a unit change in yield.

Standard Deviation

Standard deviation is a statistical measure of the range of an investment’s performance. When a mutual fund has a high standard deviation, it means its range of performance is wide, implying greater volatility.

Sharpe Ratio

The Sharpe Ratio, named after its founder, the Nobel Laureate William Sharpe, is a measure of risk-adjusted returns. It is calculated using standard deviation and excess return to determine reward per unit of risk.

Beta Ratio (Portfolio Beta)

Beta is a measure of an investment’s volatility vis-a-vis the market. The beta of less than 1 means that the security will be less volatile than the market. A beta of greater than 1 implies that the security’s price will be more volatile than the market.

AUM

AUM or assets under management refers to the recent/updated cumulative market value of investments managed by a mutual fund or any investment firm.

Holdings

The holdings or the portfolio is a mutual fund’s latest or updated reported statement of investments/securities. These are usually displayed in terms of percentage to net assets or the rupee value or both. The objective is to give investors an idea of where their money is being invested by the fund manager.

Nature of Scheme

The investment objective and underlying investments determine the nature of the mutual fund scheme. For instance, a mutual fund that aims at generating capital appreciation by investing in stock markets is termed an equity fund or growth fund.

Likewise, a mutual fund that aims at capital preservation by investing in debt markets is a debt fund or income fund. Each of these categories may have sub-categories.

How to Read Mutual Fund Fact Sheet – Rating Profile

Mutual funds invest in securities after evaluating their creditworthiness as disclosed by the ratings. A depiction of the mutual fund in various investments based on their ratings becomes the rating profile of the fund. Typically, this is a feature of debt funds.

Mutual funds invest in securities after evaluating their creditworthiness as disclosed by the ratings. A depiction of the mutual fund in various investments based on their ratings becomes the rating profile of the fund. Typically, this is a feature of debt funds.

Average Maturity

The weighted average maturity of the securities in the scheme.

Macaulay Duration (Duration)

Macaulay Duration (Duration) measures the price volatility of fixed income securities. It is often used in the comparison of interest rate risk between securities with different coupons and different maturities. It is defined as the weighted average time to cash flows of a bond where the weights are nothing but the present value of the cash flows themselves. It is expressed in years. The duration of fixed income security is always shorter than its term to maturity, except in the case of zero-coupon securities where they are the same.

Portfolio Yield (Yield To Maturity)

The weighted average yield of the securities in a scheme portfolio.

Total Expense Ratio (TER)

Total expenses charged to scheme for the month expressed as a percentage to average monthly net assets.

Portfolio Turnover Ratio

Portfolio Turnover Ratio is the percentage of a fund’s holdings that have changed in a given period. This ratio measures the fund’s trading activity, which is computed by taking the lesser of purchases or sales and dividing it by average monthly net assets.

Tracking Error

Tracking error indicates how closely the portfolio return is tracking the benchmark index return. It measures the deviation between the portfolio return and the benchmark index return. A lower tracking error indicates portfolio is closely tracking benchmark index and higher tracking error indicates a higher deviation of portfolio returns from benchmark index returns.

Risk-Free Return

The theoretical rate of return of an investment with the safest (zero risk) investment in a country. Normally Call Market Rate or 10 Year G Sec or Savings Bank Deposit Rate is referred as Risk-Free rate.

Growth and Cumulative option

Growth and Cumulative words are used alternatively. They mean the same Growth Option

Any other term on How to Read Mutual Fund Fact Sheet? Please ask me through the comments section below.