In an earlier article, we were discussing whether buying a house or saving for retirement is important. After all, all of us want retirement homes when we usher in the sunset years. The last thing you want is a mad struggle to meet your day to day expenses and on top of that pay rent as long as long as you live. Hence, it is always advised to buy a home early on in life, however very few of us buy with the thought of retiring in the same house.

Loosely define, a retirement home is nothing but a home where you want to retire. But retirement homes have special features made available to them – things like clinics or bigger hospitals might be in the campus with ambulances on standby. The houses are made ‘elderly proof’ – with non skid tiles and bathrooms with support structures. One rarely thinks about all of these things when one purchases a house today because we want the house to live in today and not 20 or 30 years down the line when we have to retire.

So the question is – amidst your constant challenge on where to invest for your retirement, how do you plan for a home that you will retire in ?

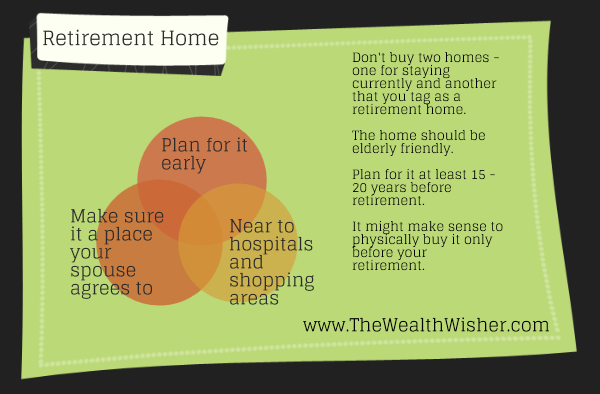

Plan early for a retirement home

Firstly, with spiraling real estate prices, it is not feasible for the ordinary investor to invest in two homes – one which is a retirement home with the above features and another house which real estate developers are selling in abundance these days and which do not have such features – a simple 2 BHK house can easily cost Rs 50 lakhs and that is a huge sum of money – so two houses will mean a stretch that many investors just cannot meet.

Now, it is also true that you would not want to buy a retirement home today and move in it – partly because retirement homes are for the elderly and you can move in only after a certain age and partly because you yourself might want to live with an age group where your family can enjoy their stay each day.

Even if you have the money muscle to buy a retirement home and not live in it, the question remains whether you will live in it say after 10 – 20 years when the place requires a major uplift. You will have to also incur the maintenance and recurring charges that a house brings with itself. Not to mention the lower rent that you will get as compared to what the house will cost you.

I personally feel that one should buy a house that one wants to stay in today. The rest of the money one should invest in a goal based investing manner to meet future goals in life. If money permits, one can plan to invest money to buy a retirement home some years before retirement, say a couple of years. In that way, maintenance and society charges do not have to be paid for a longer tenure and you are free from the physical encumbrances of managing too many bricks in your life.

When and where ?

You would know by now how much money you need to retire and you would be putting in that money each month/year into different investment classes to meet your daily expenses at retirement. What could work is to save for a retirement home in this manner – of course with the assumption that the sale of your current house will go towards funding the retirement home when you plan to buy. Managing non real estate investments are any day easy and can be done at the click of a mouse than is it to manage a house.

I have many friends who have bought a plot of land – with the assumption they will build a house there when they retire. As long as the land is in a well demarcated and gated community, it can work great but if a Kholsa Ka Ghosla happens to you, then you will know how painful it is to manage real estate. My advice is to keep it simple.

What you also need to keep in mind is that you need to buy a house sometime in your life – the earlier the better. Otherwise you are leaving the time you have to clear your home loan very less – read on how loans work to understand this better. This might impact some major goals that you have – children’s education for example. You also need to ride on the tax benefits that the government offers to you when you buy a house – however meager you find that.

Financial planners recommend buying a house, retirement or otherwise, 15- 20 years before you retire. I agree with this and would suggest to buy just a couple of years as long as your focus is a retirement home. Note that you need to put some time thinking on where you want to retire. Our mobile life today takes us all over India and the world – quite a few of us buy real estate as we go along in each city. However, a retirement home should be bought where you and your spouse want to live your sunset years – could be your hometown for all you know . Also be sure you know you are buying the right retirement home at the right time.

I must hastily also add that you can continue to live post retirement in the same house which you might have bought in your 20s or 30s or 40s as long as the house is near to healthcare facilities and things that you need daily. One does not need to specifically buy a retirement home when you hit 60 but if at all you do, remember how to play it out as per the above.

What do you think?

Fantastic advice. Buying a retirement home just before retirement is what I have planned. I think retirement homes will get much better 10-20 years from now. Buying a home is a highly emotional aspect and difficult to use logic or math to convince people.

I agree Pattu, it is really very emotional. Do you really think people cannot be convinced or it is tough to do so ?

I agree that one must plan for a retirement home and buying that in the last 2-3 years before retirement also sounds good but a word of caution is that the prices are rising every year and homes have always been a scarce commodity so imagine the amount of money one has to take out for such a home in 20-30 years from now. How about hedging that risk through a second home now and when it gets to retirement, move into a retirement home and pay by selling this. Might just work for many.

I agree Sushil but why do you need a second home NOW ? So why not have ONE home now and sell it off to buy a retirement home. That way, even if prices rise, the current home’s prices will also rise and compensate.

Also buying 2 homes today might be a very difficult task for many middle class individuals – any thoughts ?

Buying a second home now..maybe a 1 bedroom small house is always advisable. Rent it out and between the rent and tax deduction on the interest (100% of the interest is allowed resulting in a tax loss and thereby yearly tax payouts are reduced)substantial part of the emi is covered.

however this should not be the Cost of messing up your asset allocation