New Year is a month away but brokerage houses and hedge fund managers have started debating on what equity markets 2018 India would be like?

Morgan Stanley (which has given 1L figure for Sensex by 2030) came first in predicting 2018 to be a 7-8% returns year. Quick revert from our homegrown Prubhudhar Lilaldas that it will 20% something. Many are just waiting to open their mouth.

And here I am wondering, do markets hear these predictions or pleas? Will market respond to demands of these research or brokerage houses, or will it hear prayers of retail investors who have just put a lot of money in penny stocks, IPOs and waiting for a big gain?

And here I am wondering, do markets hear these predictions or pleas? Will market respond to demands of these research or brokerage houses, or will it hear prayers of retail investors who have just put a lot of money in penny stocks, IPOs and waiting for a big gain?

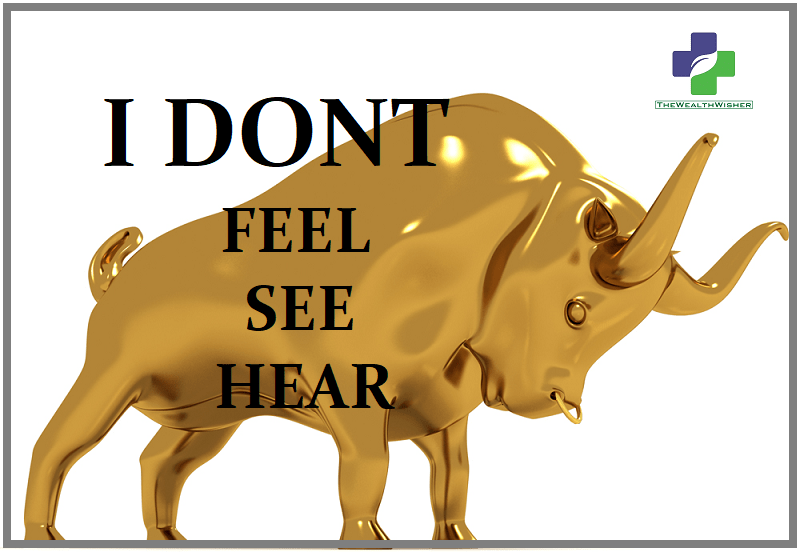

I have never seen markets listening to anyone or moving on predefined track. I also do not subscribe to media definition of markets when they call it “drunk elephant” Markets are never intoxicated but yes they are emotionless, blind, deaf (to prayers) & zero in math. Let’s see how…

Last week I visited an equity broking office (a branch of a multinational) with one of my investors for his work related to physical shares. We reached early morning by 9 am and were surprised that in an office when markets are to surprise to see only cleaning staff. Soon as they say “moments arrives”, here enters the flock of staff. Within 2-3 minutes all 12 workstations were occupied by just passed-out & just became market guru looking boys. Soon phones started ringing and it was a fish market.

We waited as we wanted to meet a senior person. The branch manager entered around 10. We wanted to meet him as we were already there for an hour. But na na.. Office boy signaled us to wait. The branch manager started praying (must be his daily habit). He was fully devoted and ignited the agarbattis (incent sticks) and started murmuring chants. He took 15 more minutes for all this, blessed everyone in staff, blessed every PC which were booking transactions non-stop. And then we could meet him.

After our work, I could not resist and asked, why you pray so long that too in office hours. He said, “market to Bhagwan bharosey hi hain na” (equity markets runs at the will of God). God save us from mediators who think God is running the markets!

Markets never care for

Your cost of buying. You bought cheap or at a high price is determined by researchers. The market will move to only one price – the deserving price. It may take few days, weeks or years. Markets will not move to break even or recoup your wrong price.

Your cost of buying. You bought cheap or at a high price is determined by researchers. The market will move to only one price – the deserving price. It may take few days, weeks or years. Markets will not move to break even or recoup your wrong price.

- The returns you need to hit your financial goals. The market does not know you, your goals or your aspirations or expectations. You have to decide what returns you need. High returns are your dream and markets are not responsible for fulfilling these

- Markets don’t care about your investing lifecycle. You are young or about to retire are not markets subjects to know. Markets only know the amount of money and stocks where you have a position.

- Markets are heartless. They never will care for your feelings. Emotions get in the way of investments but the markets have no sympathy. Your emotions of getting too excited, nervous, scared or greedy about your holdings are your lookout. Ego is the worst way to make poor decisions when money is at stake.

- Your choice of simple stocks or complex “surgical strikes”. Choosing more complex does not automatically lead to better returns. Simple and easy to understand businesses make more returns.

- Your influences or legendary investor quotes. Your favorite Warren Buffett or Seth Klarman quotes or their life isn’t going to help you the next time when you are in a bear

- Markets are blind to time and effort you put into your investments. Portfolio Manager Porinju says he just puts 5-7 minutes research. Warren Buffets say read 500 pages daily. Market work for both of them. Markets do not care your literacy levels. The research s for you to find a right candidate and make a price decision.

- Markets have no respect for how successful you are in real life. Success in other fields of life doesn’t always translate into success in the equity markets. Markets will punish over-confidence.

Making or studying big charts. The markets don’t care how much data you have on your Excel Sheet or what color you choose to make jaw-dropping graphs. Change the y-axis to x-axis but it’s not going to help you make more money.

Making or studying big charts. The markets don’t care how much data you have on your Excel Sheet or what color you choose to make jaw-dropping graphs. Change the y-axis to x-axis but it’s not going to help you make more money.- You are a “Bhakt” or not, the market does not care political views. Markets are non-political They don’t care about your voting preferences or you watch Zee News or NDTV.

- Markets do not care about last Sixer that you hit. How much money you made in lifetime or on your last trade. Investors have a memory or sense of pride but the markets do not. One day you win the second day you lose- market takes you as a first timer

- Markets just follow rules. Their own rules -not yours. Markets never care you are sick, on vacations, you are cash-strapped, you are on job, you are getting married or bereavement in the family. Markets are pure emotionless.

Hope this write-up makes you strong and focused on the things that you should and ignore the things which you have no control over.

Please share your experience and expectations for equity markets 2018 India. Do share this article to speak out loud that you read good stuff.