Just say these 2 sentences in your mind…

I am an Indian

I belong to Bharat

Got it? Bharat is a word which we rarely use and this is why it is exclusive and nostalgic. Gives you a feeling of belonging and attached to roots. Same is what our government disinvestment department thought this time. Instead of naming the offering something like CPSE or Pt Deen Dayal ETF, they named it Bharat 22 ETF. Here is Bharat 22 ETF review with features infographic for you.

What I feel about Bharat 22 ETF and how it can be compared with previous ETF (CPSE) here is the link. Since now we know the features, let’s have Bharat 22 ETF review in details.

Question: What’s an ETF?

Answer: It’s a mutual fund scheme that is compulsory bought & sold on the stock exchange. So you need a DEMAT account to buy it and trading account if you want to trade or do transactions after the scheme is listed.

If you want to know about ETFs in details, click here.

Is ETF Promising?

ETF business in India as on 30 Sept 2017

Management of Bharat 22 ETF

ICICI Prudential Mutual Fund has been appointed by Government to manage Bharat 22 ETF.

The S&P BSE Bharat 22 Index is designed to measure the performance of select companies dis-invested by the Central Government of India according to the disinvestment program.

- Stock weighting mechanism – Free Float Market Capitalization Weighting Method: Means stocks available for trading.

- Weight caps – Stock level cap: 15%; Sector level cap: 20%: Means a good diversification with concentrating.

- Re-balancing – Annually in March: This is not a great feature. One year is huge in stock markets. If a company under-performs, the fund manager will not exit/reduce the stock.

- Additions/ deletions to the index – As per GOI notification on their website: Means government may add or delete more shares in the fund.

Bharat 22 ETF companies with sector percentages

My simple inference here is that Bharat 22 ETF has major 6 sectors. What if one or more sectors go off the demand. Basic Materials, Pharma & FMCG are cyclical in nature. The ETF does not have IT, Airline, Automobile, Cement etc sectors which are also part of the overall economy.

So it is a heavily Banking & Finance, Infrastructure & Energy tilted portfolio. Currently, everything is making money (thanks to bull run) so it may be ok, but what when the economy changes gears?

Returns Test

Here is a comparison of Bharat 22 ERT for last 10 Years As on 26 Oct 2017 (Source ICICI Pru MF)

Comparison with Few Large Cap Diversified Funds: as on 31 Oct 2017

Performance is good.

Fund is a Large Cap with 61 : 39 Government- Private company ratio

Future of sectors under Bharat 22 ETF

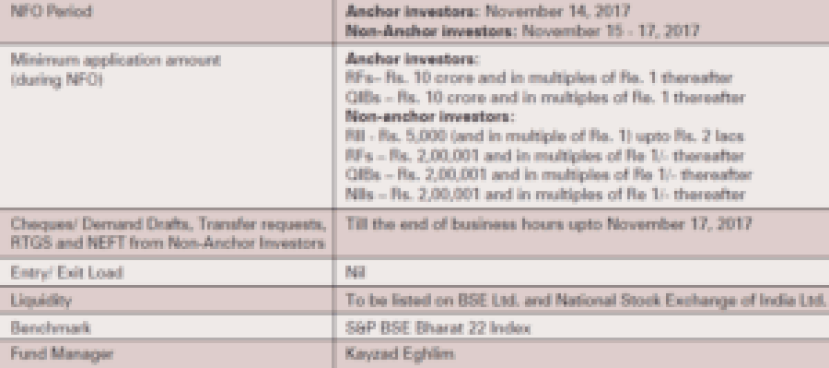

Features of the New Scheme & Bharat 22 ETF Launch Date

Final Verdict: Bharat 22 ETF Review

Why should you invest?

- You are a seasoned equity investor and wish to invest in large caps.

- You want to invest in a portfolio with Banking, Industrial & Energy companies.

- If you prefer looking at investing in Index Funds with low cost.

- Few companies like L&T or SBI are really good to invest and one can own them through this ETF.

- 3% discount is small but saves something at least.

Why should you not invest?

- PSUs and PSBs management are not of good quality. It is a fact.

- All the stocks in the ETF are at 52 week high or near 52 week high. Would you like to purchase when banks in the portfolio have already risen over 30% plus (due to Bank Recapitalization announced before Diwali)?

- Top 3 Stocks make 39% of the fund. Top 6 Stocks make 61% of the fund. Huge risk. Any adverse movement in these 6 stocks the fund will have very hard time.

- The portfolio is sectoral heavy. One sector downturn will cause huge volatility. If you are not looking at volatility you should stay away.

- In case your portfolio requirement is midcap or multi-cap, this fund is not for you.

- You are not a direct equity investor, you should not rush to open a demat and trading account for this. Alternatives are there.

- You cannot do a SIP in this scheme. But you can buy units on monthly basis using your trading account.

- This is not a debt fund since Government is behind it. It’s a pure Equity Scheme and Debt Investors should not look at it as a substitute to dividends and fixed returns.

I hope you liked the portfolio break up and my Bharat 22 ETF review.

Share this with your family & friends and let me know what you think?