Income is classified under five heads in the Indian Income Tax Act. Each year, you or your qualified chartered accountant is expected to put all your earnings or incomes under these 5 heads of income for calculating tax.

Here is a small primer of what these 5 heads of income mean and what all they consist of.

Income from salary

Income can be charged under this head only if there is an employer employee relationship between the payer and payee. Salary includes basic salary or wages, any annuity or pension, gratuity, advance of salary, leave encashment, commission, perquisites in lieu of or in addition to salary and retirement benefits.

The aggregate of the above incomes, after exemptions available, is known as Gross Salary and this is charged under the head income from salary.

Basic salary along with commissions and bonuses is fully taxable.

Allowances : An allowance is a fixed monetary amount paid by the employer to the employee for expenses related to office work. Allowances are generally included in the salary and taxed unless there are exemptions available.

The following allowances are fully taxable : dearness allowance, city compensatory allowance, overtime allowance, servant allowance and lunch allowance.

Specific exemptions are available for some allowances as shown below.

Conveyance Allowance : Upto Rs 800/- a month is exempt from tax.

House Rent Allowance (HRA) : Hop over the House Rent Allowance article to check on calculation and exemptions available.

Leave Travel Allowance (LTA) : LTA accounts for expenses for travel when you and your family go on leave. While this is paid to you, it is tax free twice in a block of 4 years.

Medical Allowance : Medical expenses to the extent of Rs 15,000/- per annum is tax free. The bills can be incurred by you or your family.

Perquisites : Perquisites (or personal advantage) are benefits in addition to normal salary to which an employee has a right by way of his employment. Examples of these are rent free accommodation or car loan. There are some perquisites that are taxable in the hands of all categories of employees, some which are taxable when the employee belongs to a specific group and some that are tax free.

Your employer will give you Form 16 which will contain all the earnings, deductions and exemptions available.

Income from house property

Any residential or commercial property that you own will be taxed as well. Even if your piece of real estate is not let out, it will be considered earning rental income and you will need to pay tax on it.

The income tax blokes are a bit easy going on this – they tax you on the capacity of the real estate to earn income and not the actual rent. This is called the property’s Annual Value and is the higher of the fair rental value, rent received or municipal rent.

The Annual Value can go through a standard deduction of 30% and if you reduce the interest on borrowed capital, then you get the value which is charged under the head income from house property.

Profits and gains of business or profession

Income earned through your profession or business is charged under the head “profits and gains of business or profession”. The income chargeable to tax is the difference between the credits received on running the business and expenses incurred.

The deductions allowed are depreciation of assets used for business; rent for premises; insurance and repairs for machinery and furniture; advertisements; traveling and many more.

Capital gains

Any profit or gain arising from transfer of capital asset held as investments are chargeable to tax under the head “capital gains”.

Hop over to the Long Term and Short Term capital gains article to read more about this. Might be worth reading to see how indexation is used in long term capital gains scenario to reduce tax outgo.

Income from other sources

Any income that does not fall under the four heads above is taxed under the head “income from other sources”. An example is interest income from bank deposits, winning from lottery, any sum of money exceeding Rs. 50,000 received from a person (other than from relative, on marriage, under a will or inheritance).

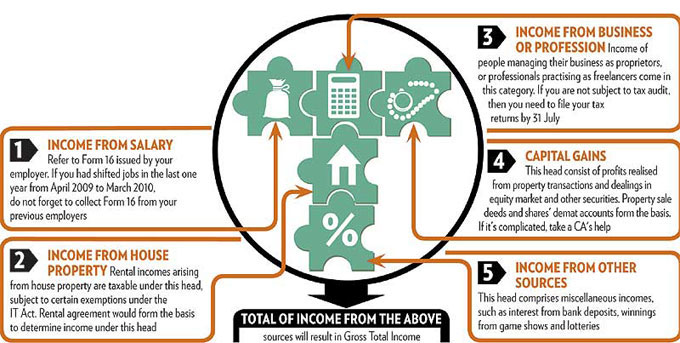

Here is a snapshot of the above 5 heads of income, courtesy Outlook Money.

Image from Outlook Money

Hi Radhey,

Thanks for worthy and useful information at apt time.Keep rocking.

Regards,

RaviShankar

@RaviShankarKota, Thanks Ravi. I will be publishing more before March end. It will help before the tax season.

please intimate the head of account of Income tax of Pb Govt employees.

Thanks

Darshan Singh

@Darshan Singh, Not sure I understand the question Darshan. Can you clarify ?

please intimate the TDS Rates & Service Tax Rates

Hi, thanks for given information in tax and income of head.

Regards

Wasfa

provide me the informaions on income tax slab , tds vat,& service tax s rates for a.y 2012-2013

sir,

provide me income tax five head with short explanation in one chart .

@Mohan Rankawat, Here you go –

https://www.thewealthwisher.com/2011/02/06/5-heads-of-income-in-the-indian-income-tax-act/

Thank you for your kind information ….!

thnx for this useful info.its very helpful

tax information is clearly and very usefull for C.A students

Hi,

I work in a restaurant. Could you plz tell me if the tips which the customers pay me by their own will subject to TDS. The tips are the tips which the customers pay through their credit cards which in turn are paid by my employer to me at the end of every week.

Thanks.

Roussel,

Yes the tips will be part of your income and be taxable.

in 204, what is meant by Income under salary? at tax details tab in e-file site. is it Gross salary? or is it head salary or is it salary after all deduction?

Thanks,

Neeraj

Hi Neeraj,

Did you get am answer? I also want to know the meaning of that term.

Excellent presentation and also very useful. Can you please, give more details on Income from House Property partially self occupied and partially rented, with tax implications. Thank You, REGARDS. Muthusankar.

thank u for giving information

It’s very Good For Knowledge

Thanks for the information…

I work in a corporate sector .have sufficient knowledge about the account field more or less hardcore accounting . Could you plz tell me if the tips which the customers pay me by their own will subject to TDS. The tips are the tips which the customers pay through their credit cards which in turn are paid by my employer to me at the end of every week. Thanks.