If you belong to those sea of people who are looking at some of the best ways to save income tax in India in 2013, look no further. This is your guide which will help you choose the tax saving investment options.

Many investors must be looking to invest their money to save tax for previous year 2012-2013 – just note that most of the options given below are still valid for that purpose and for investments that you make in the first 3 months of January, February and March – but you need to be careful to cram all the investments in these 3 months. You must first understand the five heads of income, read up on how much income tax can be saved by you and have a look at 80C deductions that you can use.

Some of the best ways to save income tax in India in 2013

Employee Provident Fund

The Employee Provident Fund is meant for all employees in the organized sector. The income that you receive is tax free and you can withdraw your money only during retirement. At 8.50% returns per annum, the EPF is a great tool to save tax for salaried people – forced savings has it own advantages and the money that gets automatically deducted from your salary account can form a nice little corpus at retirement.

EPF scores very low on the liquidity front – you just cannot pull out money as and when you wish. A withdrawal is allowed but only for emergency needs like a child’s marriage or building a house. While it compromises on the liquidity, it scores very high on the safety aspect.

Ensure that you do not dip into your retirement savings come what may otherwise you will lose out big time at the time of retirement.

Public Provident Fund

The Public Provident Fund (PPF) as it is commonly called is another alternative of the best ways to save income tax in India in 2013. PPF is meant for risk averse investors and is good for those who cannot save via the EPF. Self employed professionals should take a serious look at the PPF as an ideal retirement saving tool.

For those who do not know, small savings schemes returns have now been linked to the market and hence the PPF is giving returns at 8.8% this year. Like the EPF, the PPF scores very poor on the liquidity front as one can make partial withdrawals from the 6th year onwards. It is a safe investment option.

Bank Fixed Deposits

The 5 year bank fixed deposits are another investment option to save tax in 2013 for risk averse investors. One needs to be aware that the money is locked in for 5 years so you cannot withdraw it before that. The safety aspect is also very high.

With the 5 year bank fixed deposits offering in the range of 8% – 9%, investors can look to park their money in this investment option for 2013.

Insurance Policies

This is the favourite for those who are caught in the investment is insurance rut. Such people are also sitting targets for insurnace companies wanting to close down on sale of insurance products during the first 3 months of the year.

There are different types of life insurance policies in the market, the non market linked ones – endowment, whole life, moneyback plans will offer a meager 6% – 7% returns to you on an average. Your money is safe as it is not exposed to the market volatility – that is something which another category of insurance policies find themselves in – Unit Linked Insurance Plans (ULIPs).

ULIPs give you a plethora of options to invest your money in and partial withdrawals are possible. So you can go for the most risk option and channel your premiums in the stock market or in the debt market or mix and match both. The safety of your money depends on which option you chose.

The income that you receive from insurance policies is tax free. While ULIPs are suitable for those who can understand long term investing and how the stock markets work, the non market linked insurance policies are for risk averse investors who are happy with the low rate of returns. As far as liquidity is concerned, ULIPs have a lock in of 3/5 years post which your money is made available to you but the endowment plans can return money to you only at maturity.

New Pension Scheme (NPS)

Another option among the best ways to save income tax in India in 2013 is the NPS. Again, it gives you an option to invest both in equity and debt so its returns are linked to the market. Unfortunately, there are no withdrawals permitted before retirement so investors might not fancy that a bit.

Equity Linked Saving Schemes (ELSS)

The ELSS are nothing but tax saving mutual funds which have a lock in for 3 years – you can withdraw your money after this mandatory lock in period. Since they invest in the stock market, they will give you decent returns but their safety aspect is therefore low. Hence these are meant for investors who understand the stock market and are willing to ride the volatility for some decent returns.

As of today, the income tax rules exempt the dividends and the capital gains you make on selling them and with a return of approximately 15% in the last 1 year (2012), these make sense to be looked at.

For those who want some exposure to equity, the ELSS is one of the best ways to save income tax in India in 2013.

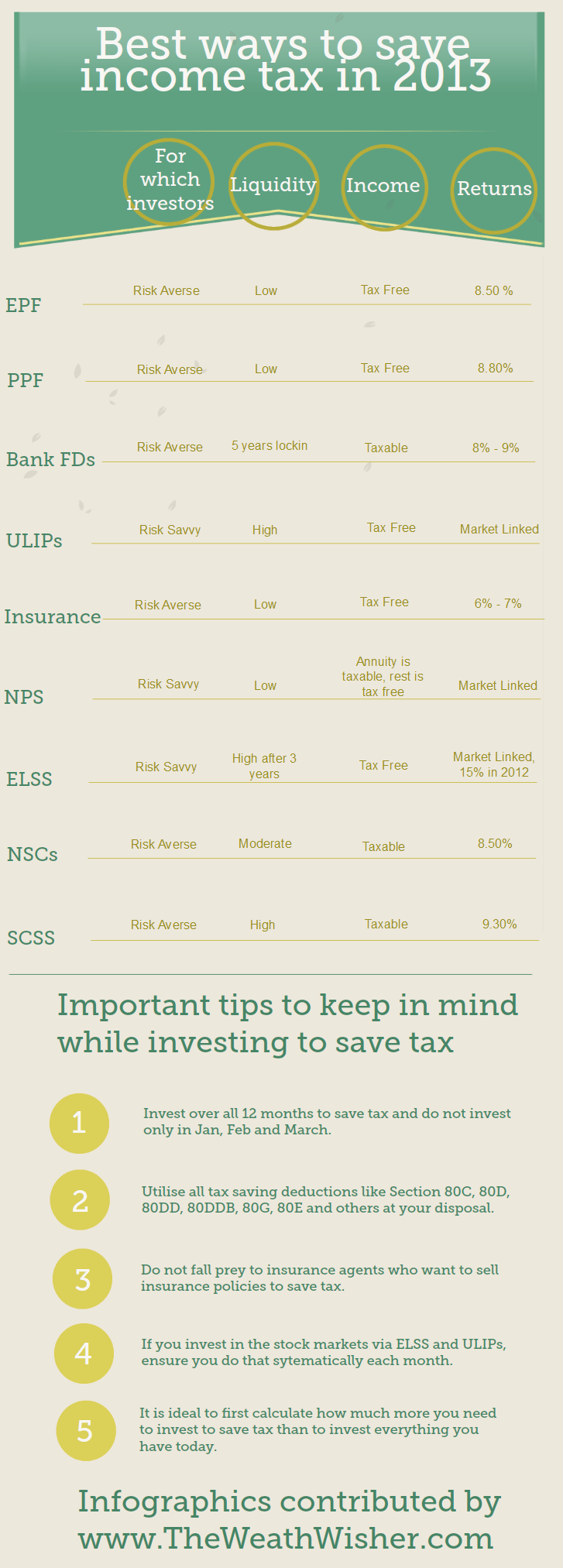

And finally here is an infographic which talks about other options like the Senior Citizen Saving Scheme (SCSS) and National Savings Certificate (NSC) apart from the ones mentioned above.

Infographic of the best ways to save income tax in India in 2013

![Best ways to save income tax in India in 2013 [infographics] Best ways to save income tax in India in 2013](https://i0.wp.com/www.thewealthwisher.com/wp-content/uploads/2013/02/Best-ways-to-save-income-tax-in-India-in-2013.png?resize=727%2C2025)

Good summary of the options. Have added to my pinterest board.

I also did a similar one Choosing Tax Saving options : 80C and Others

Thanks for that mate.

Hi,

Please mention RGESS also. This is introduced in this FY.

Regards

Kranti

I will do that Kranti. Thanks for pointing out.

Nice Infographics. But some points may create confusion in the mind of readers. Like In NPS you have written “Annuity is taxable…rest is tax free” and above you wrote that “return from insurance policies are tax free” etc. I mean one needs to dig deeper into the product and understand when the returns will be non taxable. may be due to space constraint you could not be able to detail the article. You have also missed on RGESS (on which you already have a detailed post) , new tax saving options like ” Preventive health care check up” etc. I have also tried to do write on the same subject …it may benefit your readers

http://goodmoneying.com/tax-planning-2/which-tax-saving-scheme-you-should-invest-this-year

Yeah Mani, agreed, I will update this post by this weekend. Thanks for your inputs.

Nice article on your blog.

Good job. I have split my investment across EPF, PPF, Term Plans and ELSS for now.

Thanks Rakesh.

Overall It’s a good article and infographic 🙂

I was expecting a detailed one 🙂

Lol Mihir – detailed in what manner – Can try to improve.

Comparison of returns between various tax saving instruments is nice

Thanks !

Very Short and informative post… thnx for sharing your knowledge with us..

Regards

Hi,

If the tax for this year for me is 8000 then how much should I need to invest. Is there any way like to deposit monthly that in online or with the help of net banking rather than depositing one huge amount in FD.

Shameem, your question is not clear to me. Can you clarify ?

It means your taxable income is Rs 2, 80, 000 (10.3% on Rs. 80, 000 is Rs. 8, 240). So you need to invest a minimum of Rs. 80, 000 to save the whole of the tax.

As regards the second part of the question, yes a lot of banks offer the facility of online investment in the Fixed Deposits (tax saving or otherwise). You have to go and have a word with your bank regarding this matter. You can also invest in ELSS mutual funds online for saving taxes.

The infographic is a good ready reckoner, how come there’s no mention of home loan and interest deduction on the same?

Good catch – I must have been sleeping when I got to this article 🙂

Nice and informative but I am curious to know which insurance plan gives 6%-7% return !!